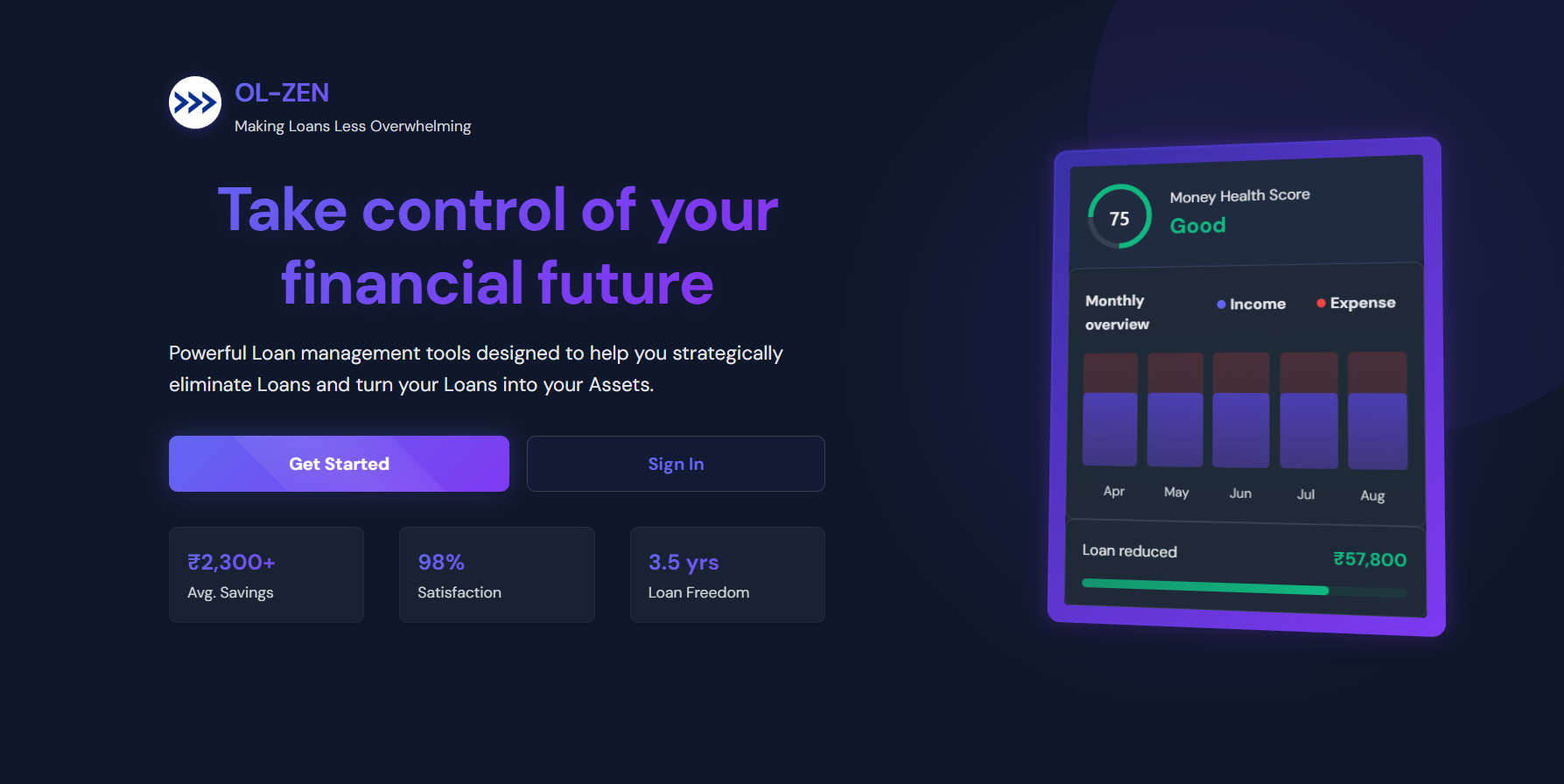

Managing Your Loans Made Easy

Take control of your finances and avoid debt traps with the help of OverLeveraged ZEN.

Regain Power Over Your Debt

Say goodbye to overwhelming loan and hello to financial stability.

Fast and Accurate Results

Why spend hours crunching numbers when OverLeveraged ZEN can do it for you?

Recognize the Problem

Poor financial awareness is a widespread issue in our society, leading countless individuals to fall into debt traps. At OverLeveraged, we aim to educate and empower people like you towards better financial management and debt-free & more importantly stress-free living.

Product.

Get a loan health check and personalized financial guidance with our OverLeveraged ZEN.

Loan Health Check

OverLeveraged ZEN analyzes your loan information and provides a detailed report on your current loan health. Also helps you save tons of interest amount & time on loans.

Personalized Financial Therapy for Free.

This is for people, who are suffering from loan burden, we understand your problem and happy to talk to you, no financial advice, just talking to someone who understands your problem.

Check Your Loan Health

Users who reduced loan

70+

and counting…

Time saved

20+

Years…

User Satisfaction

98%

Interest saved

50L+

and counting…

Client Testimonials

Hear from our satisfied users about how Overleveraged helped them manage their debt.

“I never thought I could manage my loans until I tried OL ZEN. The dashboard showed me exactly what I needed to do. I’m on the right path now!”

Dhiraj

Ahmedabad

“Using OverLeveraged ZEN was a wake-up call! I learned so much about managing my money, and now I feel in control of my life again”

Upendra

Bengaluru

“I used to feel anxious every time I opened my bills. Now, OL Zen’s tracker feels like my personal cheerleader. I’ve paid off 23 lakh in student loans… and my anxiety is gone”

Anjali

Patna

Contact Info

Let’s Talk

Home | About Us | Contact Us | Terms | Privacy Policy