Borrowing money is a significant financial decision, whether it's for a new business venture, higher education, or an unexpected personal emergency. Traditionally, banks have been the go-to source for loans in India. However, peer-to-peer (P2P) lending platforms are emerging as a popular alternative. So, are peer-to-peer lending platforms safer than traditional loans? Let's delve into a detailed comparison to help you decide.

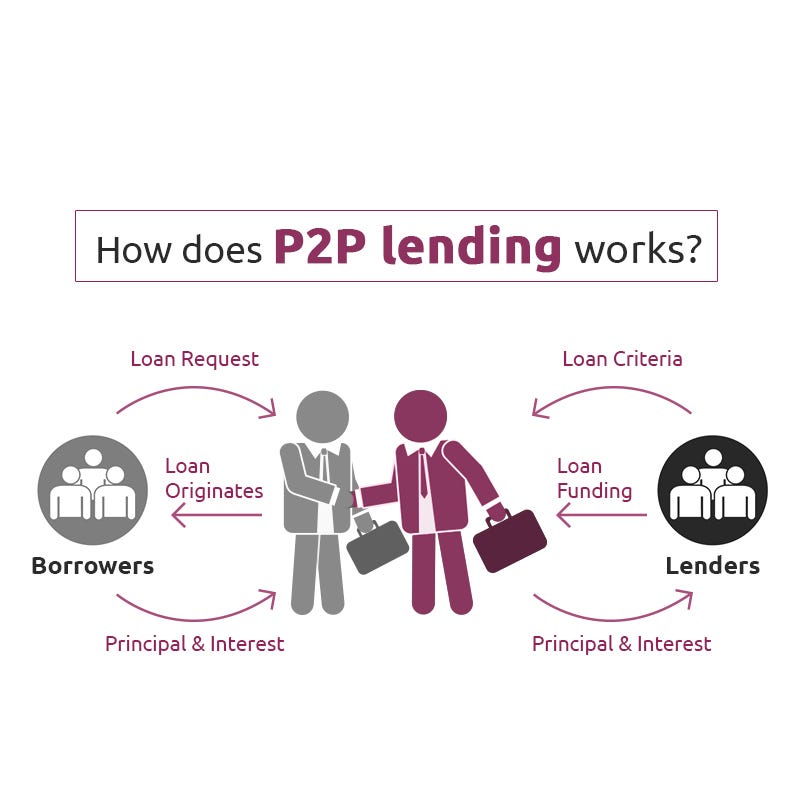

Understanding P-to-P Lending

Source : Medium

P2P lending platforms cut out the traditional financial intermediary (the bank) and connect borrowers directly with individual investors willing to lend their money. This entire process happens online, making it convenient and often faster than securing a traditional bank loan. It's like borrowing money from a friend or family member, but on a larger scale and with a structured platform managing the process.

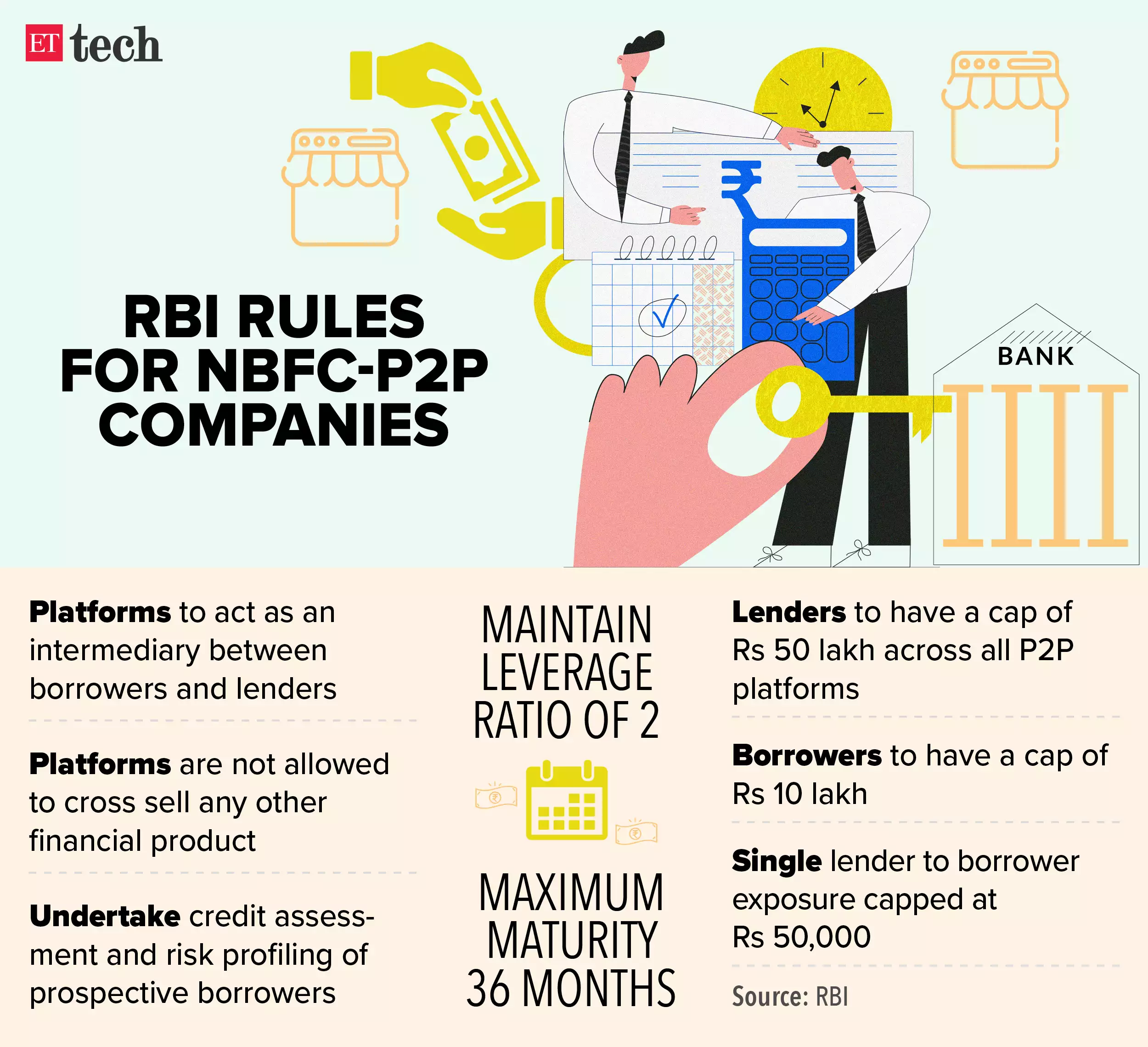

Assessing the Safety of P2P Lending

P2P lending offers the allure of potentially higher returns for investors and lower interest rates for borrowers. However, understanding the associated risks is crucial. Unlike bank deposits, P2P investments aren't typically covered by deposit insurance. According to a report by the Reserve Bank of India (RBI), as of March 2023, the aggregate loan portfolio of P2P platforms reached ₹1282 crore, highlighting the growth of this segment. [Insert hyperlink to RBI report here]. This means if a borrower defaults, investors could lose their money. While P2P platforms conduct credit checks and risk assessments, diversifying investments across multiple borrowers is essential to mitigate potential losses. Tools like Overleveraged can offer personalized financial strategies to help you make informed borrowing decisions.

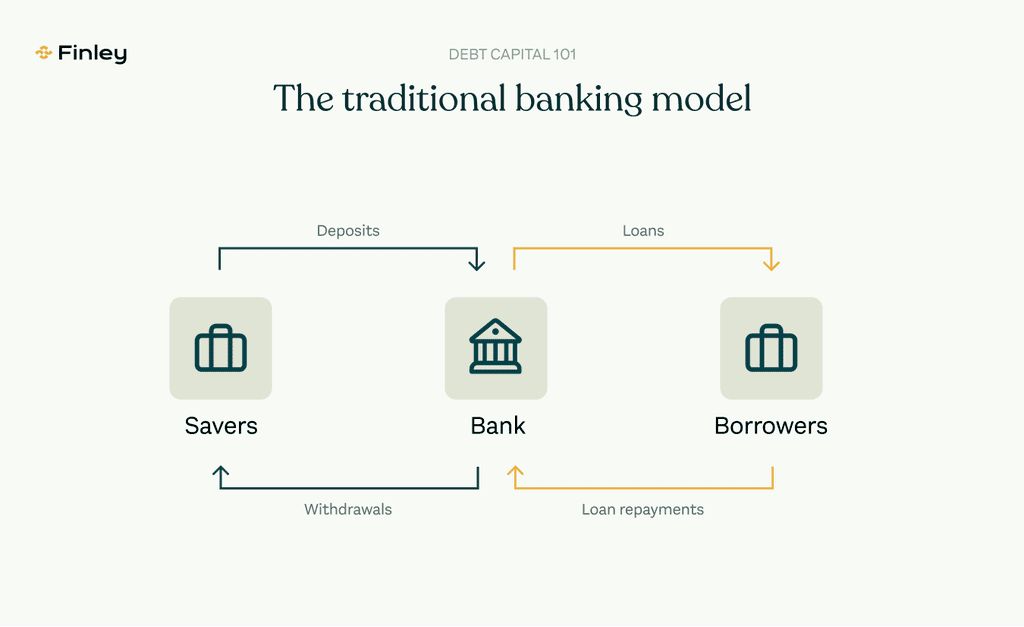

Bank Loans: The Traditional Approach

Source : Finley

Bank loans offer a sense of familiarity and security, backed by regulations and deposit insurance schemes like the DICGC, which insures deposits up to ₹5 lakhs per depositor per bank. [Insert hyperlink to DICGC information here]. However, the process of obtaining a bank loan can be lengthy, often involving extensive paperwork and stringent eligibility criteria. Interest rates may also be higher compared to P2P lending, potentially increasing the overall cost of borrowing.

P2P Lending vs. Bank Loans

Feature | P2P Lending | Bank Loans |

Interest Rates | Potentially lower for borrowers | Can be higher |

Access | Easier and faster application process | Longer process, stricter eligibility | |

Security | No deposit insurance, higher risk for investors | Deposit insurance (up to ₹5 lakhs), generally safer |

Regulation | Regulated by RBI | Heavily regulated by RBI |

Flexibility | More flexible loan options often available | Less flexible |

Choosing the Right Option

The best borrowing option depends on your individual financial circumstances and risk tolerance. If you're an investor seeking higher returns and are comfortable with a degree of risk, P2P lending might be worth considering. As a borrower, if you prioritize quick access to funds and potentially lower interest rates, P2P could be a suitable option. However, if security and a well-established regulatory framework are paramount, a traditional bank loan remains a reliable choice. Thorough research, comparing interest rates, and reading reviews are essential steps before making a decision.

In conclusion, both P2P lending and bank loans have their own set of advantages and disadvantages. Carefully weigh the risks and benefits of each option to determine the most suitable path for your financial needs. A well-informed decision is crucial for your financial well-being.

Are Peer-to-Peer Lending Platforms Safer Than Traditional Loans?