Ever wondered how much of your monthly EMI payment actually chips away at your loan and how much goes towards interest? Understanding this split can be crucial, especially if you're feeling overleveraged (OL). Knowing where your money goes empowers you to make informed financial decisions, like prepaying your loan or choosing the right loan tenure. Let's demystify EMI calculation and see how it impacts your finances.

What is EMI?

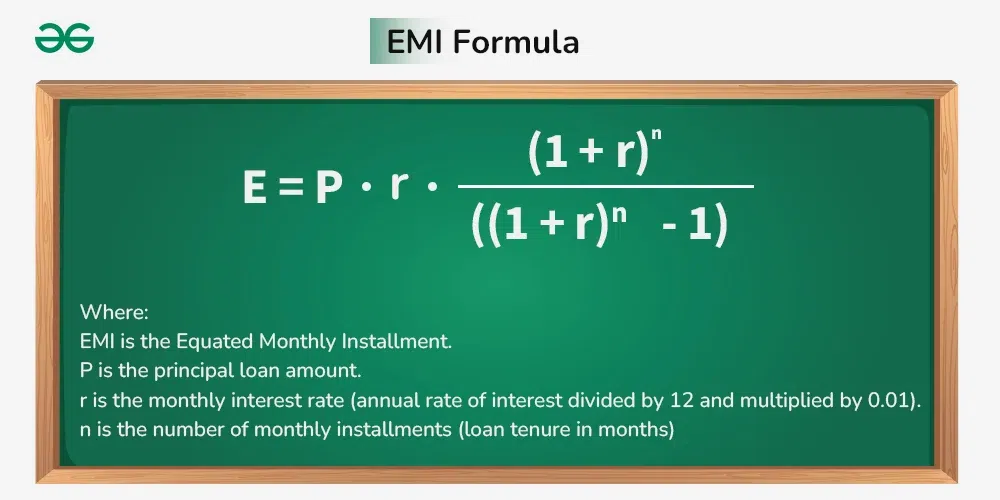

EMI stands for Equated Monthly Installment. It's the fixed amount you pay each month to repay your loan, covering both the principal (the original borrowed amount) and the interest. The EMI is calculated using a formula that considers the loan amount, interest rate, and loan tenure. While the formula can seem complex, the key takeaway is that EMIs are structured so you pay more interest initially. As you repay, a larger portion of your EMI goes towards the principal. This can be particularly relevant if you’re concerned about being overleveraged (OL) as understanding your EMI breakdown helps assess your debt burden.

How is EMI Split?

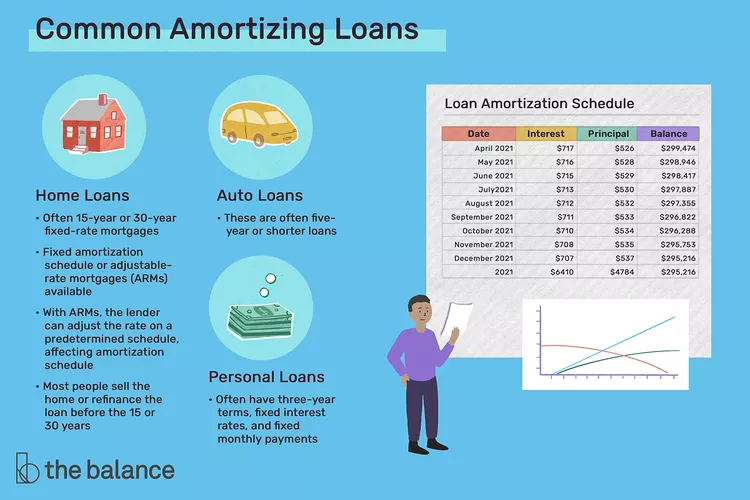

The interest-principal split within your EMI changes over time. In the initial stages of your loan, a significant portion goes towards interest. This is because the interest is calculated on the outstanding principal balance, which is highest at the start. As you make payments, the outstanding principal decreases, leading to a lower interest component in your EMI. Consequently, more of your payment contributes to principal reduction. You might be asking yourself, "how is EMI split between interest and principal?" or looking for a "breakup of principal and interest in EMI". An amortization schedule provides this detailed breakdown.

Visualizing the Split

The best way to visualize the shift from interest to principal is through an amortization schedule, sometimes referred to as an "EMI schedule with principal and interest breakup." This table details each EMI payment, showing the exact amounts allocated to interest and principal. This helps you see "how EMI is divided in principal and interest" over the loan term. You can easily find online amortization calculators or request one from your lender. This is a powerful tool for understanding your loan repayment journey, especially if you're concerned about being overleveraged (OL).

How Loan Tenure Affects the Ratio

Your loan tenure significantly impacts the interest-principal split. A longer tenure means smaller EMIs, but you'll pay considerably more interest overall. A shorter tenure means higher EMIs but less total interest paid. Understanding this trade-off is vital for choosing a term that aligns with your financial goals. For instance, a longer tenure might initially seem appealing if you're overleveraged (OL), but the higher total interest cost needs careful consideration.

Taking Control

Understanding how EMIs work allows you to strategize for reducing your overall interest burden. Making prepayments, even small ones, can significantly reduce your outstanding principal and, consequently, the interest you pay. Refinancing your loan at a lower interest rate can also be a good option, particularly if interest rates have fallen since you took out the loan. These strategies can be especially helpful if you’re overleveraged (OL) and aiming to reduce your debt.

Conclusion

Understanding how your EMI is split, sometimes referred to as "how is principal and interest calculated on EMI," is crucial for effective financial management. By utilizing tools like amortization schedules and considering strategies like prepayments, you can take control of your loan repayment and save money. Don't hesitate to ask your lender for an "EMI schedule with principal and interest breakup" or use online resources to deepen your understanding. Being informed is especially important if you're overleveraged (OL) and seeking ways to improve your financial health.

If you wanna know how you can apply such smart strategies in your own EMIs check out Overleveraged Zen a tool that carefully analyses your income, expenses and liabilities (Loans) and suggests you the best way possible to move forward with your finances.

Decoding Your EMI