The Buy Now, Pay Later (BNPL) market is booming, offering a tempting alternative to traditional credit. But with the rise of BNPL services in Malaysia and elsewhere, it's crucial to understand how these platforms operate and the potential pitfalls they present. This article explores the benefits and risks of BNPL to help you make informed financial decisions.

What is Buy Now, Pay Later (BNPL)?

Source : prove.com

BNPL is a short-term financing option that allows you to purchase goods and services immediately, paying for them in installments over time. These installments are often interest-free if paid on time, making BNPL an attractive option for those who may be short on cash or prefer to spread out their payments. Services like Afterpay, Klarna, and Affirm are leading the charge in this rapidly expanding market. For instance, the Worldpay from FIS 2023 Global Payments Report projects BNPL to account for roughly 7% of global e-commerce transaction value by 2026.

How Does BNPL Make Money?

While many BNPL services advertise interest-free installments for consumers, they generate revenue through various channels. Primarily, they charge merchants a fee for each transaction processed through their platform. This fee can vary depending on the BNPL provider and the transaction amount. Late payment fees charged to consumers who miss their installment deadlines also contribute to their revenue stream. Some BNPL providers may also offer premium services or longer-term financing options that incur interest charges, generating additional income.

The Hidden Costs of BNPL

The allure of "interest-free" installments can be deceptive. Missed payments can trigger substantial late fees, quickly turning a seemingly affordable purchase into a costly burden. While many BNPL providers offer interest-free periods for initial installments, longer repayment plans often come with high interest rates. Always scrutinize the terms and conditions to understand the total cost of your purchase, including potential fees and interest charges.

BNPL and Your Credit Score

While some BNPL providers don't perform hard credit checks during the application process, your usage and payment history can still impact your creditworthiness. Missed payments can be reported to credit bureaus, potentially lowering your credit score. A lower credit score can affect your ability to secure loans, mortgages, and other forms of credit in the future.

BNPL and Budgeting: The Overspending Cycle

The ease and accessibility of BNPL can encourage impulsive purchases and overspending. Because payments are spread out over time, it's easy to lose track of your overall spending. Creating a budget and tracking your BNPL purchases is crucial to avoid falling into a debt trap. Tools like Overleveraged can help you carefully analyze your income and expenses, providing personalized strategies for managing your finances.

Smart Alternatives to BNPL

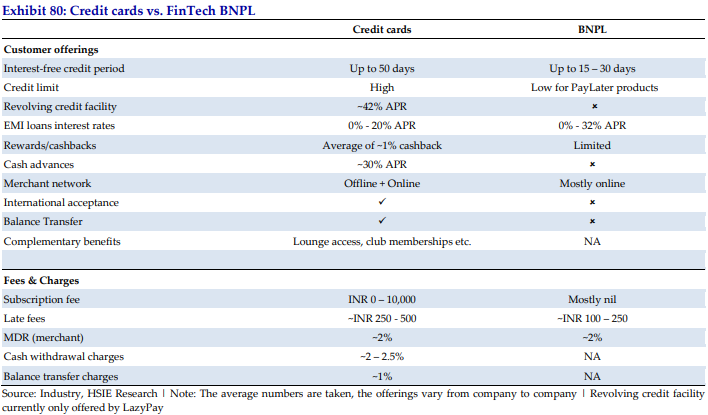

Source: HDFC securities

Consider alternative payment methods before opting for BNPL. Saving up for a purchase is always the most cost-effective approach. If borrowing is necessary, explore options like personal loans from traditional banks or credit unions, which typically offer lower interest rates and more transparent terms. Using a credit card responsibly can also be a viable option, but be mindful of interest rates and credit limits.

Conclusion

BNPL can be a convenient tool for short-term purchases when used responsibly. However, understanding the potential risks and hidden costs associated with these services is essential. By carefully considering your budget, payment schedule, and the terms and conditions of each BNPL provider, you can make informed decisions and avoid the potential pitfalls of this increasingly popular payment method.

The Rise of BNPL: Convenient Shopping or Debt Trap?